Sixth consecutive win for HSBC China! We’ve been named 'International Retail Bank of the Year' at the 2022 Asian Banking and Finance Awards.

Start your children on the path to success by planning for their overseas education early. Our global team of experts is ready to provide you with the right financial products and asset management plans you need to turn your dreams for their futures into reality.

Here's how the HSBC International Education Payment System will help you get your child's education plan rolling:

- Pay online: Save yourself a trip to the bank by paying tuition through HSBC China mobile banking

- Intelligent search-and-match functions: Search for the educational institute of your choice and retrieve the receiving account automatically

- Multi-currency exchange: We support renminbi exchanges with USD, GBP, CAD, AUD and HKD, or other foreign currency exchange combinations

- Easy payment status updates: You'll receive payment status notifications through your WeChat service account or the HSBC International Education Payment System on your Mobile Banking app

- Low to no service fees: Eligible HSBC customers pay zero service fees, while Advance account holders pay a low per-transaction service fee of just USD7 or the equivalent in another currency1

Operating channels: Log on to your HSBC China mobile banking

Payment account: Pay tuition and other relevant fees3 via your HSBC renminbi account2 or foreign currency account

Service coverage: Currently available for more than 1,000 educational institutes in the US, UK, Canada, Australia and Hong Kong SAR

Contact us

Make an online appointment to apply

Thank you for your interest in becoming an HSBC China customer and using HSBC international education services. Please leave your contact details and we'll be in touch in 1-2 business days.

HSBC International Education Financial Services Hotline (for personal banking services only)

(24H, Mon - Sun)

Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan

If you're already an HSBC customer, scan and download the HSBC China Mobile Banking app to use the HSBC International Education Payment System

How to use the HSBC International Education Payment System

To purchase foreign currency for payments within your personal FX quota

1. Log on

Log on to HSBC China Mobile Banking → HSBC Global Transfer service → HSBC International Education Payment System.

2. Fill in your information

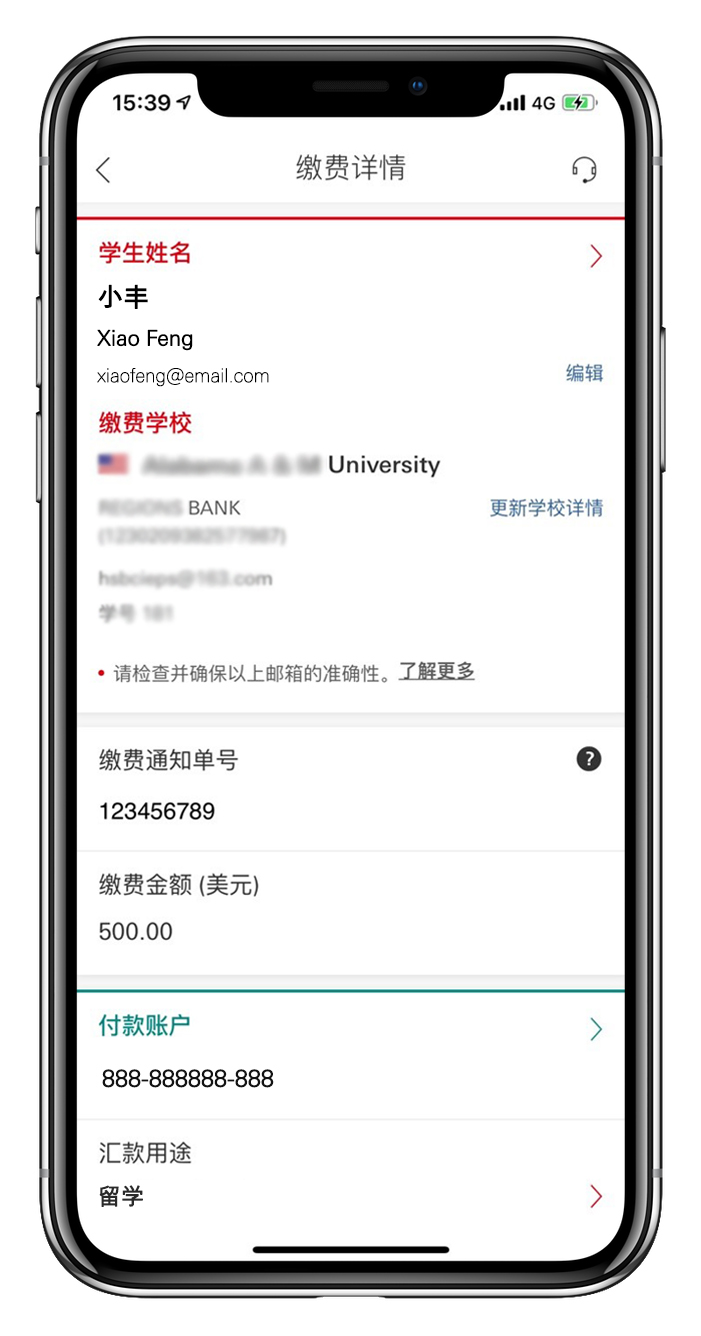

Enter 'Immediate payment' and select your educational institute. The corresponding receiving account will match automatically with the institute's name. Then, fill in all the payment information fields.

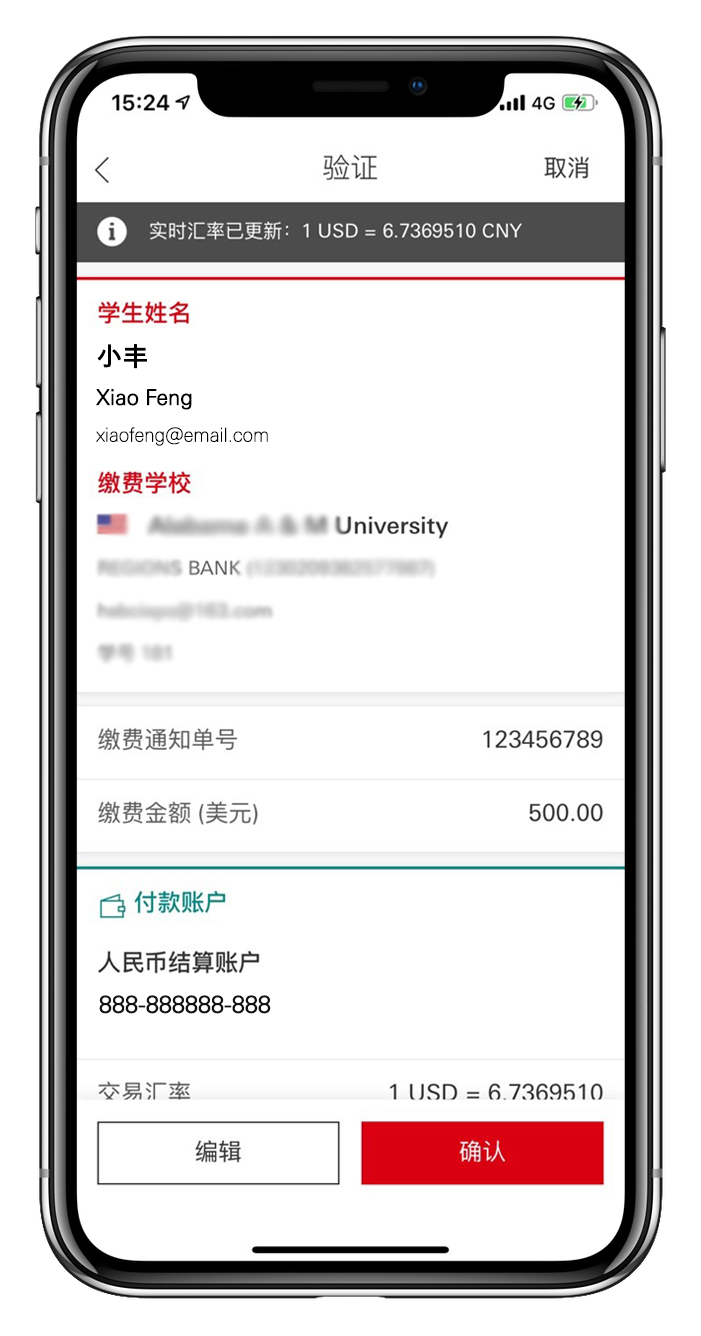

3. Verify information and confirm

Verify the information you've entered, then click 'Confirm' to submit your payment request.

4. Wait for payment to be completed

Upon payment confirmation, you'll receive details of the transaction and payment status in the payment record or by checking notifications from the International Education Payment System.

Frequently asked questions

Start banking with us

Make an appointment

Leave your contact details with us and we'll be in touch within 1-2 business days.

Call us

HSBC International Education Financial Services Hotline (For personal banking services only)

(24H, Mon - Sun)

Please dial the country code of mainland China +86 if you are calling from overseas, Hong Kong SAR, Macau SAR, or Taiwan